Property records report is all technical information about a structure or a property. From the specific size of the house, the additions made, flood zone reports and all historical records will be included with this report.

With big data just a click away, sorting through it will be a mind-boggling circus. Property records report sorts data for you and it will benefit you in the long run by saving you time and money.

Whether you’re an individual and you want to research a home that you are eyeing on or a professional working in the real estate industry and you would like the historical data for a property to price the property right.

Property Records data will summarize the data for you.

Important Features of property records report:

- Knowing historical data of the property

- How many times the property has been sold

- Are there any liens with the property?

- Verify if the current owners are the one on the deed.

- Review historical flood reports.

- Demographics report.

- Schools in the area your kids will go to.

Amenities in a certain area can boost property values in the long term.

Speeds up the process

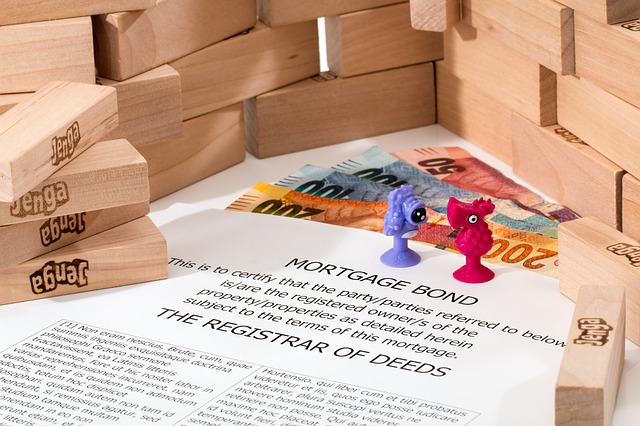

Usually, home purchases take around 30 days to close and 15 days for a mortgage refinance. That is a perfect world. In reality, mortgage closing gets delayed because of paper-centric methods that are cumbersome and inaccurate.

From lost pages of your tax returns to not legible documents were underwriting could not review. These are time wasters.

Property records data speeds up your mortgage loan application. As a result, it’ll save time both ways for the lender and borrower.

Traditionally a tedious process of collecting paper works via physical means takes a long time. Digital property records report cuts the time gathering the documents and ensures that nothing is left behind and every data will be included.

When combined with digital copies of your pay stub, tax returns, bank statements and property records report. As a result, it’ll dramatically cut the time for you to take advantage of low mortgage rates when you are refinancing or purchasing a home.

Organized Data

Now you have all your data digitally organized- when a lender asks for certain verifications from your pay stubs, deeds or tax returns.

You can quickly send it to them, and they will be able to sort information since most lenders are actively going paperless.

Therefore, it relieves you of stress and potentially locks on a better rate with your lender that saves you money in the long run.

Immediate Data is your friend

With the ever-changing mortgage market, gathering data as fast as possible can give you an edge with any real estate deal.

Beginning your research with accurate information saves you time and money. Leaving you with the energy to address other important commitments that matters to you more.