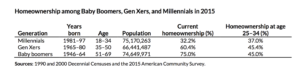

According to the Urban Institute, only 37% of millennials are homeowners.

Student debt is the primary culprit, and affordability is not helping at all. Saving for a downpayment is hard. Squeezing a budget is hard enough for a starting salary, let alone buying a home.

The mental shift from this generation changed and it shows that, for them, renting is much cheaper than buying a home.

Flexibility is also a factor. Millennials are more open to moving for a job they like and change into another one in two years. Renting is a convenience for this kind of lifestyle.

Millennials move a lot more compared to baby boomers and Gen x. They tend to take advantage of new opportunities to increase the value of their work and strategize to increase income.

Sharing and renting economy

The convenience of ride-hailing services also gave the habit of sharing more and not to have the expense

The upfront cost could be more affordable. As aforementioned, convenience is more of a priority than having the cost owning a home. Willingness to move to another city for a higher paying job is a priority for this younger folk.

Older Millennials are active in buying homes

In the last month, with mortgage rates lower than ever, sparked a home refinancing surge and a slight increase in home mortgage applications for this generation increase as well. According to CoreLogic, the lower rates incentivized the demographic to participate in home buying.

The survey with CoreLogic showed that there is an increase in demand for this generation to buy homes in the next 12 months. Given if rates stay as it is, this trend might continue.

Even the price of homes in the market has slightly increased because of the demand uptick.

With home builders still in a “wait and see” mode because of current trade tension and a threat of a recession, are not in a hurry to expand projects to build.

Unlike other goods, building materials are harder to absorb in terms of tariffs cost because of longer return on investment when building new homes.

Highlights the affordability issue for this generation.

The main reason millennials have low homeownership rates is because of the impact of debt and the affordability factor in the areas they choose to live in.

But with the Fed planning to cut rates middle of this month, current rates might stay and could spur the appetite for mortgage application for millennials on the sidelines.